It Is Too A Recovery….I Think

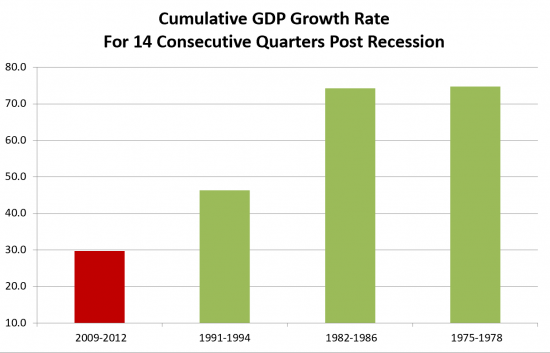

The great recession hit bottom in Q4 2008, with GDP contracting a whopping 8.9%, followed by 2 subsequent quarters of GDP contraction. The economic recovery began in Q3 2009 as evidenced by 1.4% GDP growth and subsequently the US economy has generated positive GDP growth in each successive quarter through Q4 2012. During this period, impactful industries, such as housing and automotive, have rebounded and general manufacturing activity has picked up, albeit from historically low levels. Then why don’t I feel like we are in recovery? Perhaps it’s due to the shallowness of this recovery as evidenced by the following chart depicting cumulative GDP growth in the current and three prior post-recession recoveries.

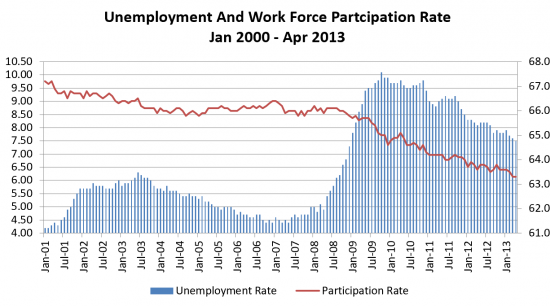

The above chart begs the trillion dollar question, why is this recovery so underwhelming? One plausible answer can be found in stubbornly disappointing employment data. We are now 45 months into a post-recession recovery, yet the unemployment rate hovers around 7.5% with much of the improvement resulting from job seekers giving up on their employment search and thus are conveniently not counted as unemployed. In fact, the work force participation rate (i.e., the percentage of working-age adults in the labor force) is at a 34 year low of 63.3%! The following chart depicts the unemployment and work force participation rate since January 2000 to provide a frame reference.

The US Federal Reserve has consistently maintained it will keep interest rates low by purchasing up to $85B in US Treasuries and mortgage backed securities per month until the unemployment rate drops to 6.5% As point of reference, assuming a 64% labor participation rate, the US labor market would have to create 229,000 new jobs per month for the next two years in order to achieve this modest target. That level has only been achieved 8 times over the prior 45 months.

- Mismatch of Skills with Opportunities: Ironically, despite the high unemployment rate there appears to be a mismatch of skills with employers’ needs. There is a dearth of skilled manufacturing talent, such as welders, CNC machinists and machine programmers. These are high paying jobs requiring knowledge of computers, math skills and ability to comprehend engineering drawings. RMB, one of our portfolio companies located Colorado Springs spent over a year before they were able to fill a machine programming position. Additionally, I recently spoke with the CEO of one our former portfolio companies located in the New England area, who mentioned they had a similar experience having recently spent 9 months trying to fill a machinist position with a starting pay package of $25/hr. plus benefits and 10% bonus potential. He lamented the lack of an adequate talent pool for skilled manufacturing positions which he believes are out of favor with the younger generation. Art Anton, CEO of Swagelok and member of MCM’s Board of Operating Partners, echoed this sentiment, adding as past Chairman of the Manufacturing Advocacy & Growth Network, they identified a need to develop the next generation of skilled machinists critical to the long term vitality of manufacturing in Northeastern Ohio. Doing a quick Google search on “shortage of skilled labor” confirms the lack of skilled manufacturing talent is a national problem and potentially a constraining factor for that segment of our economy. A greater emphasis on developing skilled manufacturing programs within the Community College environment is a viable solution.

- Lack of Mobility: Certain US geographies, many driven by unconventional oil and gas exploration, are experiencing explosive job growth and desperately need labor. However, the dramatic decline in the housing market has left many home owners underwater and unwilling to take a loss on their homes. This, coupled with 99 weeks (recently reduced to 73 weeks) in unemployment benefits has contributed to a relatively immobile work force. For example, one of our portfolio companies extended a job offer to an unemployed factory worker who asked for a start date subsequent to the expiration of his 99 weeks of unemployment benefits. When told he was needed immediately, he spurned the offer for employment.

- Cautious Demand Driven by Uncertain and Business Unfriendly Policies: In general, Washington’s policies have discouraged the private sector from new job formation. For example, CEO’s faced with the full implementation of Obamacare are being uncommonly diligent with their planned staffing, preferring to incur overtime rather than increase headcount in anticipation of dramatic increases (estimated to approximate a whopping 25%) in employee health care costs.

-

Massive New Regulatory Climate: In an article titled, Red Tape Rising: Regulation in Obama’s First Term it was noted during Obama’s first term, a total of 131 new major regulations have been imposed at a cost of more than $70 billion annually. This amount is about five times the cost imposed by the prior Administration of George W. Bush. Ask any medical device CEO about the chilling effect the new medical device tax has had on making growth oriented investments and adding to employment. Even President Obama has acknowledged the burdensome regulatory environment is impacting employment but has been either unwilling or unable to change it.

So what is the good news? Over time, the power of the free enterprise system will guide us to solutions to the above challenges. Until then, I suspect we will continue to experience consistent, albeit tepid GDP growth and historically high unemployment levels.