Seven Factors Impacting Business Valuation

Determining the value of a business is far from a straightforward discounted cash flow calculation. Regardless of whether a business owner relies on themselves, their management team, or a third party appraiser for conducting a business valuation, the exercise requires a thorough examination of the company’s balance sheet, customer base, growth prospects, intangible assets, and other factors to arrive at a meaningful estimation of fair market value.

In our prior article titled, “How to Quickly Estimate the Value of a Private Company,” we discussed a handful of business valuation methods and the mechanics of estimating Enterprise Value by utilizing a Multiple of EBITDA. While the calculation itself is relatively straightforward, arriving at a realistic business valuation can be challenging given that EBITDA multiples can vary by 60% or more! Narrowing this gaping chasm to a meaningful range requires considering the effect of critical macro (i.e., strength and trajectory of the economy, cost and availability of capital, regulatory environment, industry growth potential, etc.) and micro (i.e. company specific) factors.

Macro factors, while impactful, are largely outside the control of management and thus we will focus on critical micro factors within a management team’s control. Beauty being in the eye of the beholder, it is reasonable to assume individuals will identify and ascribe different levels of import to different factors. That being said, the following seven critical micro business valuation factors, presented in no particular order, are widely accepted to have a substantial impact on Enterprise Value:

- EBITDA Size

- Revenue Trends

- Profit Margins

- Customer Concentration

- Industry Concentration

- Strength & Depth of the Management Team

- Competitive Advantages

EBITDA Size

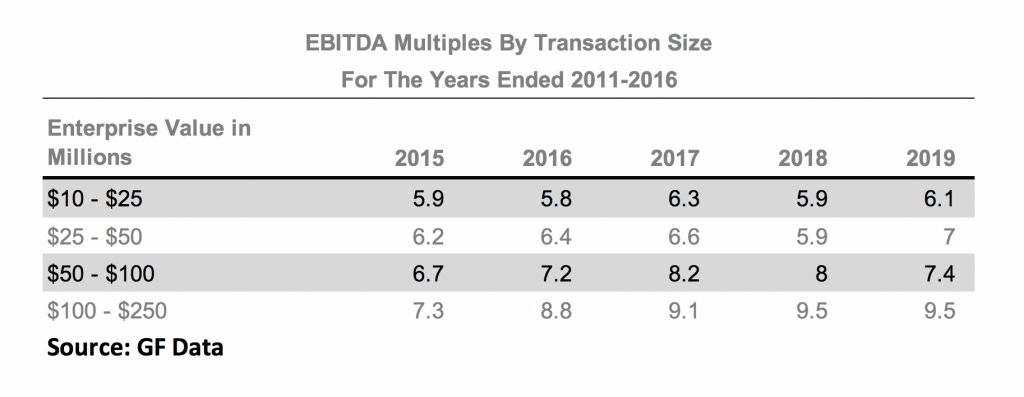

The old expression, “size matters” comes into play when selecting an appropriate EBITDA multiple for your company. Generally speaking, larger companies command higher EBITDA multiples and thus it follows larger transactions will garner a higher EBITDA multiple as evidenced in the following table:

Revenue Trends

Not surprisingly, potential buyers pay close attention to a subject company’s revenue trends in determining the value of a small business. Generally, small businesses demonstrating consistently superior historic and prospective revenue growth will typically command a premium to the prevailing average market EBITDA multiple. Conversely, companies with substandard, flat or decreasing revenues will garner a lower than average market EBITDA multiple.

It should be noted not all revenue growth is created equal. Small businesses with growth fueled by recurring revenues will transact at a higher multiples than like companies experiencing a revenue spike due to a significant, one time project. This is because recurring revenues provide more stable, predictable and reliable cash flows than project based revenue.

Profit Margins

Companies generating relatively high gross margins typically command a valuation premium. As a rough guide, we define “relatively high” gross margins (exclusive of depreciation expense) as exceeding 35% for manufacturers and 25% for value-added distributors. Strong gross margins are generally indicative of a company possessing competitive advantages through valuable, differentiated offerings, unique distribution channels and/or enhanced production capabilities. This usually leads to a higher EBITDA multiple as each incremental dollar of revenues generates better than average profitability.

Customer Concentration

The magnitude, or absence, of customer concentration significantly influences Enterprise Value. Other things being equal, companies having significant customer concentration, which we define as any single customer responsible for more than 20% of annual sales or any 3 customers generating over 50% of annual sales, command lower than average EBITDA multiples than industry peers possessing equivalent revenues and profitability yet with a more diverse customer base.

Companies have a handful of tools at their disposal to mitigate the potential negative impact of customer concentration on their marketability. For example, acting as a sole source supplier and/or having favorable long-term agreements with large customers can help address a potential buyer’s concerns over a customer base.

Industry Concentration

Companies whose revenues are concentrated within a particular end market are more susceptible to the impact of sector specific variables not generally within the company’s control, such as its cyclical nature, the introduction of new regulations or disruptive technologies, increased competition, etc. could give potential buyers pause. Of course, in certain situations, industry concentration may be viewed positively. For instance, a company serving an end market growing faster than Gross Domestic Product (“GDP”) may command a premium EBITDA multiple. Industries currently growing faster than GDP are plastics, medical, and aerospace, to name a few.

Strength and Depth of the Management Team

It is not uncommon for smaller companies to be overly dependent on the entrepreneurial talent of its CEO/Owner who may be primarily responsible for more than one key functional area. While such situations are not unusual, over-reliance on a single person results in, or the perception of, increased business risk. All else being equal, the market is more apt to assign a higher value to a company possessing a more complete management team with talented individuals leading the key functional areas of Sales and Marketing, Finance, Engineering, and Operations.

Competitive Advantage(s)

Warren Buffet eloquently addressed the subject of competitive advantages when saying “….so we think in terms of that moat and the ability to keep its width and its impossibility of being crossed as the primary criterion of a great business. And we tell our managers we want the moat widened every year.” In other words, sustainable competitive advantages serve to protect the business from the potential intrusion of competitors, thereby reducing business risk and increasing growth prospects. Consequently, business buyers are willing to ascribe a premium multiple to a company having a strong competitive advantage, which may come in the form of intellectual property, unique capabilities or services and/or proprietary processes to name a few. More often than not, these competitive advantages also come through in a company’s financial performance, since businesses are able to charge a greater price premium (and customers are willing to pay more) for their unique value-added products and services.

Summary

Ultimately, business valuation is more of an art than a science and the factors influencing Enterprise Value are not intended to be an exhaustive list. However, recognizing and assessing critical business valuation factors can highlight areas needing improvement prior to bringing your business to market and allow one business owners to develop realistic expectation for the value of the business.

To provide business owners with an idea of their business’s enterprise value, we created a Business Valuation Calculator that provides a quick valuation estimate based on their responses to several questions about their company.

If you are interested in learning more or have questions concerning how the foregoing might impact the value of your business, please contact Chris Hren at [email protected]