This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Business Valuation Calculator

Private Equity firms generally value a business based on a multiple of EBITDA. The multiple used to determine the value varies depending on a number of factors specific to an individual business.

How would you describe your Competitive Advantage?

20 1_9No technical advantages with products and services comparable to those offered by competition

Some technical expertise not widely available, allowing company to enjoy a small premium

Own IP or technical expertise, allowing company to enjoy substantial premium

How would you describe your Management Team?

15 1_9CEO wears several hats and senior management team is limited to (1) key member, with (3) or more immediate hiring needs

Senior Management team made up of (3) strong managers, with (2) hiring needs within the next two years

Senior Management team well staffed with no apparent hiring needed to support growth

What is your company’s average Gross Margin?

Gross Margin = Revenue – Cost of Goods Sold (labor, manufacturing overhead & material)

15 percent 20 35How would you describe your Customer Profile?

15 1_9Project oriented or one-time purchases / Local Market

Mix of one-time and recurring revenue / regional market

Small, recurring purchases / Blue-Chip multi-national

What is your company’s average Growth Rate over the last three years?

15 percent 0 7How would you describe your Customer Concentration?

15 1_9Top 5 customers account for greater than 80% of revenues

Top 5 customers account for less than 50% of revenues, with no single customer accounting for greater than 20% of revenues

Top 5 customers account for less than 30% of revenues, with no single customer accounting for greater than 10% of revenues

How would you forecast your Market Growth over the next five years?

5 1_90% growth per annum

5% growth per annum

Growing faster than GDP, 10% or more per annum

What is your company’s EBITDA?

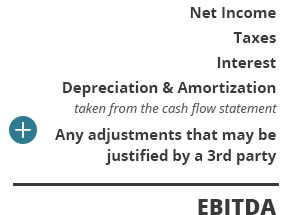

EBITDA can be calculated using the bottom-up method:

Calculation Complete

Estimated Enterprise Value:

Why This Value?

To discuss the factors impacting your company's value with an investment professional, please fill out this form.