Case Study

MCM Capital Case Study - Anatomy of a Leveraged Recapitalization

Inservco Corporation

Electronic manufacturing services provider focused on low to mid volume, high complexity printed circuit board assemblies, and systems integration.

Anatomy of a Leveraged Recapitalization

In the typical leveraged recapitalization, a company partners with a private equity group, which invests equity in conjunction with debt provided by senior and, possibly mezzanine lenders. The debt obligations are secured by the future cash flows of the business. The cash may then be used for the purpose of redeeming shares from the shareholders on a capital gains tax rate basis. The ratio of debt to equity varies considerably from transaction to transaction and is influenced by the same factors that determine capital structure in a buy-out transaction including the consistency of the company’s earnings, capital expenditure requirements and the company’s anticipated growth rate.

Frequently, a leveraged recapitalization represents an ideal alternative to an outright sale of a business. While it is frequently believed that strategic buyers (e.g., competitors) will pay the best price for a business, this frequently is incorrect. With the proliferation of sophisticated private equity groups, purchase price multiples are frequently comparable to those of strategic buyers, and transaction structures can usually be tailored to the specific needs of the seller.

Using the leveraged recapitalization structure, private equity groups allow business owners to unlock the majority of the illiquid value contained in their business while continuing to retain a significant ownership interest in the target business. Moreover, private equity groups allow operating control to continue to reside with management. The leveraged recapitalization serves to diversify significantly the business owner’s net worth, typically allowing him to realize 80% to 90% of the value of his business while continuing to maintain an ownership position of 20% to 40% of the company. In addition, the business owner gains a dedicated and well-capitalized corporate development partner to identify potential acquisition candidates or alternative growth strategies.

Leveraged recapitalizations are most prolific with business owners who are not ready to retire but have built significant value in their businesses. Frequently these individual business owners encounter changing risk profiles over time. Business strategy becomes dictated in part by wealth preservation rather than wealth creation. Major capital expenditure plans may get shelved; entering new markets may seem less attractive. Further complicating matters, senior lending institutions frequently seek personal guarantees for corporate expansion loans. Accordingly, not only is the entrepreneur’s net-worth tied to the business, he may have further exposure from the personal guarantees tied to the corporate loans. In summary, leveraged recapitalizations allow the business owner to diversify his personal net worth such that the bulk of it is outside of the business while simultaneously eliminating the need for personal guarantees.

A leveraged recapitalization can also be an effective method for a generational transfer of wealth. For example, an entrepreneur may enter into a leveraged recapitalization wherein he achieves significant liquidity and can gift a substantial ownership interest in the company to his heirs on a taxed advantaged basis. Over time the appreciated stock may be sold at capital gains rates bypassing estate-taxes. Other permutations of the leveraged recapitalization include allowing members of the management team to obtain equity in the business on a favorable basis as well.

Mathematic Example

Stellar Corporation is a niche manufacturing company generating $38 million in revenues and $5 million in earnings before income taxes, depreciation, and amortization (EBITDA). The owner of Stellar founded the enterprise during the mid 1980s and now, by virtue of its success, he finds 90% of his net worth in one investment, the stock of Stellar. While Stellar’s owner is only in his early 50’s, he recognizes perhaps he should start thinking about diversifying his portfolio for prudent estate planning purposes. Moreover, he has a plan to take the company to $60 million in revenues over the next three years, but to do so will require undertaking a significant capital expenditure project to launch a new facility that he knows isn’t without risk. Finally, Stellar’s owner has a loyal and dedicated key group of senior executives who have been instrumental in building the business and are now clamoring for a “piece of the action”.

Over the years Stellar’s owner has been receiving numerous letters of inquiry from brokers and private equity groups and finally, he responds to MCM as he is comfortable with their down-to-earth Midwestern style. Immediately, Stellar’s owner and MCM hit it off with a shared vision of operational excellence, and within a week they have agreed on a transaction which provided $27.5 million in cash plus 40% of the equity being retained by Stellar’s owner, prospectively. Stellar’s owner decides to reward his key managers with a 15% ownership stake and retains 25% for himself. At this juncture, Stellar’s owner is elated as he will be receiving approximately $25 million in cash proceeds ($27.5 million in cash received less the $2.5 million reinvestment) and he and the management group continue to own 40% of the equity.

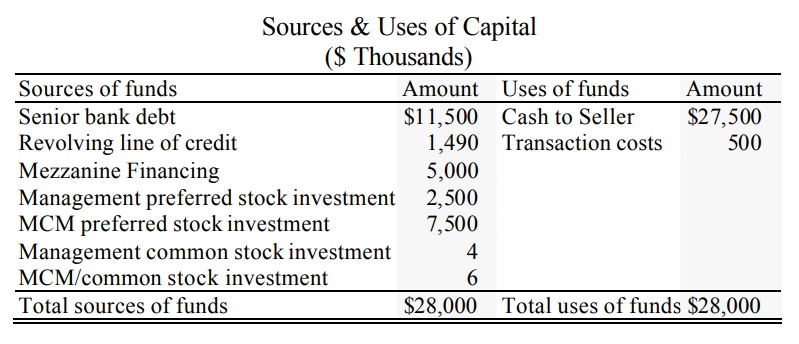

Set forth below is an example of how the capital structure of the transaction would likely be crafted.

Assuming Stellar continues a 6% annual growth rate in sales and commensurate EBITDA improvement over the next five years (the seller is planning a major expansion so this might be conservative), the selling shareholder and his management group will receive an additional $15 million payout resulting in a significant second liquidity event for him and the next tier of management.

It is important to note that while there is a debt burden being placed on the company’s balance sheet, intelligent private equity groups are deft at crafting capital structures which are both tax efficient through the use of debt financing yet flexible to allow for major capital expenditure programs and to withstand the vagaries of overall business conditions.

Case Study: Inservco

Inservco, based in Lagrange, Ohio is a contract electronic manufacturing services (“CEM”) business, which was acquired during 1968. By 1999 the founders had built Inservco into one of the top 100 CEM businesses in the United States. While the founders enjoyed the satisfaction of building the business, they, like most entrepreneurs, had the majority of their net worth locked within the company. The founders recognized they were approaching a point in their lives where it was prudent to unlock much of the substantial value they had created but were not yet ready to retire. Initially, they reviewed various proposals regarding the purchase of the business from several strategic buyers. MCM was introduced to the owners and proposed a leveraged recapitalization. The MCM approach was intriguing because it offered the following benefits:

- A valuation for the business that was comparable to the strategic buyers.

- Substantial personal liquidity.

- The satisfaction that the employee base and management team would remain intact.

- The continuing control of the business.

- A financial partner with the capital resources to help fund additional growth and the corporate development expertise to help find and execute strategic acquisitions.

The owners of Inservco concluded that the best strategic alternative was a leveraged recapitalization with MCM. In light of the company’s growth rate, MCM structured the transaction with an approximate 50/50 split of debt and equity. MCM split its equity commitment between preferred stock and common stock and provided approximately 92% of the equity capital. Management rolled over approximately 8% of their sale proceeds for a continuing equity interest of 30%. In summary, the owners were able to achieve a “have your cake and eat it too” transaction, which provided substantial liquidity and a significant ongoing ownership position in the company.

Calculate the Value of Your Business

Wondering how much your enterprise is worth? Use our online Valuation Calculator and quickly receive an estimation range for the value of your business.