MCM Capital Exits Investment In Performance Plastics

MCM Capital Partners (“MCM”), a lower middle market private equity fund, is pleased to announce the sale of Performance Plastics (“PPL”), a precision injection molder of highly engineered thermoplastics. PPL doubled revenues and more than doubled EBITDA during our partnership, resulting in an attractive outcome for MCM, its shareholders and the PPL management team.

“Over the last 6.5 years we worked closely with PPL’s senior leadership to develop a sustainable growth strategy targeting high value applications which leveraged PPL’s unique technical capabilities.” Stated Mark Mansour, Senior Managing Partner at MCM Capital. “PPL is another example of how MCM can work closely with our portfolio teams to drive positive change.”

MCM acquired PPL in 2015 as part of its direct sourcing effort to acquire manufacturers possessing expertise in processing highly engineered thermoplastic resins. PPL was a prototypical MCM investment, possessing highly differentiated capabilities, serving growing, high-value end markets, but had not yet fully realized its full potential due to historically underinvesting in sales and marketing.

Given the Company’s minimal business development efforts, at the time of acquisition its new program pipeline was underwhelming. To drive qualified prospects to PPL, the MCM team created a strategic marketing program inclusive of actively rewriting the Company’s website and implementing extensive digital marketing programs positioning the company as a solutions provider for potential customers’ most challenging thermoplastic components. Additionally, the Company recruited a VP of Sales and Marketing (position did not previously exist) and subsequently added two full-time sales and marketing professionals. To support the resulting growth, the Company added six engineers, an Operations Manager and a Quality manager.

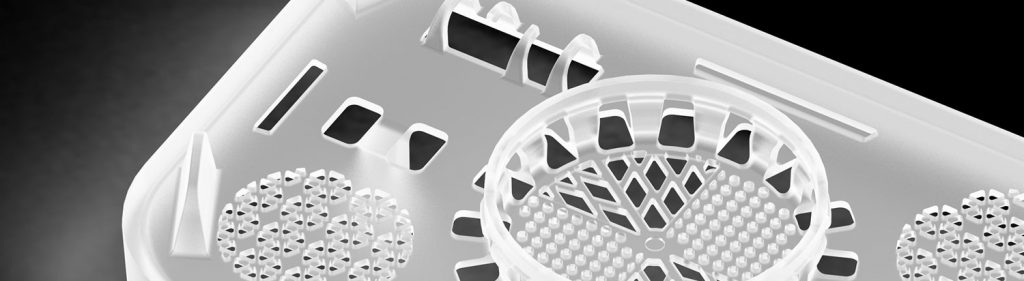

PPL’s reputation and culture had always centered around outstanding quality and its ability to tackle difficult to manufacture components. We made substantial capital investments to strengthen this competitive advantage including, but not limited to, adding a state-of-the-art metrology lab with 3D CT Scanning capabilities, several fully automated work cells featuring robotic handling and vision inspection systems. A few years into our hold period, PPL doubled the size of its facility, enabling the installation of several specialized work cells, the consolidation of offsite warehousing and a more efficient manufacturing flow.

“From the beginning, MCM partnered with the PPL leadership team and supported our growth efforts. This just wasn’t adding the necessary capital equipment, but more importantly, building out the next generation of problem solvers. This was critical and key in the maturation of the business and to support an aggressive growth plan.” Said Chris Lawson, Chief Operating Officer at PPL. “Their Operating Partners were invested in the development of our team and challenged PPL to ‘think out of our box.’ This shift in philosophy led to a significant increase in both the quality and quantity of new business opportunities, and as importantly, positioned the company to execute on those opportunities. As critical as they are in selecting businesses to invest in, they had the same emphasis on finding the right partner for PPL to continue our growth and support our staff moving forward.”

Greg Ott, MCM Senior Operating Partner and Chairman of the Board at PPL, added, “It was both personally and professionally rewarding being part of such a talented management group at Performance Plastics. Our collective skillsets and personalities meshed exceptionally well and their execution of our strategic initiatives dramatically elevated PPL’s market presence as well as benefited its existing customers.”

About MCM Capital Partners

Based in Cleveland, OH, MCM Capital is a lower middle market private equity fund focused on acquiring niche manufacturers, value-added distributors and specialty service businesses possessing significant competitive advantages and generating between $2-$8 million in EBITDA. MCM is actively seeking additional platform and add-on acquisition opportunities.