Business Valuation Calculator

Private Equity firms generally value a business based on a multiple of EBITDA. The multiple used to determine the value varies depending on a number of factors specific to an individual business.

How would you describe your Competitive Advantage?

20 1_9No technical advantages with products and services comparable to those offered by competition

Some technical expertise not widely available, allowing company to enjoy a small premium

Own IP or technical expertise, allowing company to enjoy substantial premium

How would you describe your Management Team?

15 1_9CEO wears several hats and senior management team is limited to (1) key member, with (3) or more immediate hiring needs

Senior Management team made up of (3) strong managers, with (2) hiring needs within the next two years

Senior Management team well staffed with no apparent hiring needed to support growth

What is your company’s

average Gross Margin?

Gross Margin = Revenue – Cost of Goods Sold (labor, manufacturing overhead & material)

15 percent 20 35How would you describe

your Customer Profile?

15

1_9

Project oriented or one-time purchases / Local Market

Mix of one-time and recurring revenue / regional market

Small, recurring purchases / Blue-Chip multi-national

What is your company’s

average Growth Rate over

the last three years?

15

percent

0

7

How would you describe

your Customer Concentration?

15

1_9

Top 5 customers account for greater than 80% of revenues

Top 5 customers account for less than 50% of revenues, with no single customer accounting for greater than 20% of revenues

Top 5 customers account for less than 30% of revenues, with no single customer accounting for greater than 10% of revenues

How would you forecast

your Market Growth over the next five years?

5

1_9

0% growth per annum

5% growth per annum

Growing faster than GDP, 10% or more per annum

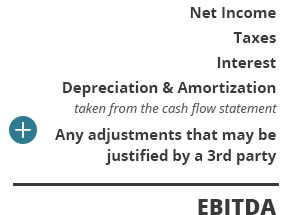

What is your company’s EBITDA?

EBITDA can be calculated using the bottom-up method:

Let’s Calculate the Value of Your Business

Fill out the form to gain instant access to your estimated business value based on the questions you’ve answered.